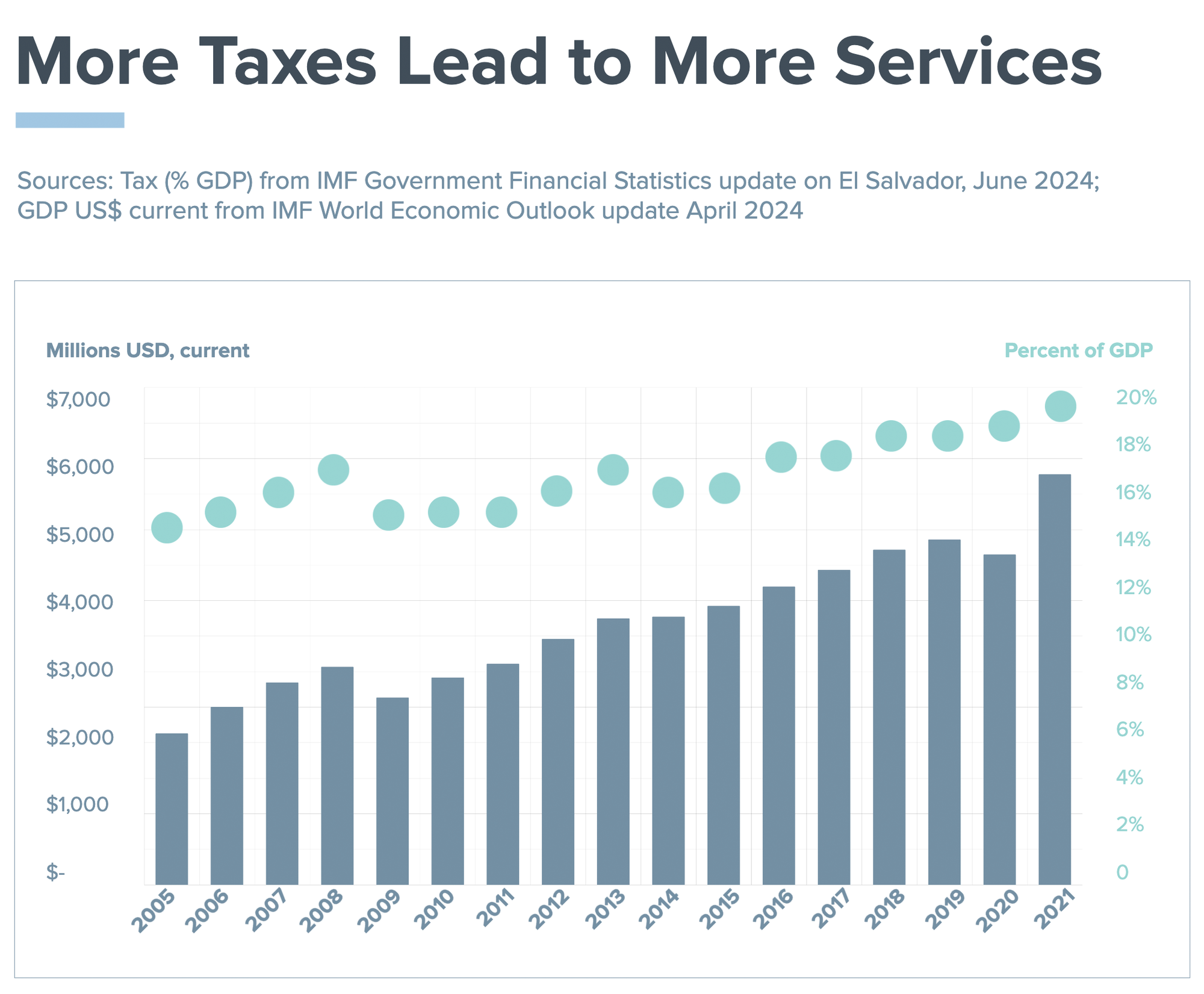

Efforts to increase tax revenue can have a profound and positive impact on a country’s ability to deliver quality basic services. When deployed effectively, higher tax revenue can fund infrastructure, healthcare, and educational investments—the pillars of a thriving society.

To help boost tax revenue and modernize public financial management in El Salvador, DAI led the U.S. Agency for International Development (USAID) Domestic Resource Mobilization (DRM) Activity from 2017 to 2023. DAI’s 35-year record of development partnership in El Salvador features projects related to the environment, education, and governance, and includes nearly 20 consecutive years of support for fiscal and public financial management reform.

DRM built on the work of the DAI-led USAID Fiscal Policy and Expenditure Management Program (FPEMP), which similarly worked with the Government of El Salvador from 2011 to 2017 to improve revenue collection, facilitate results-oriented budgeting, and upgrade public financial management systems. Capitalizing on the progress made by FPEMP, DRM aimed to mobilize tax revenue equivalent to 2 percentage points of gross domestic product (GDP)—translating into hundreds of millions of dollars in additional revenue for the country. DRM focused on supporting the government to mobilize revenues and improve public expenditure management to promote transparency and accountability in the use of public resources.

By the end of DRM, DAI had successfully supported the government to boost tax revenue by an additional 2.11 percentage points of tax revenue to GDP, from 17.64 in 2017 to 19.75 in 2022, thus exceeding the target.

Finding Windows of Opportunity to Mobilize Revenue

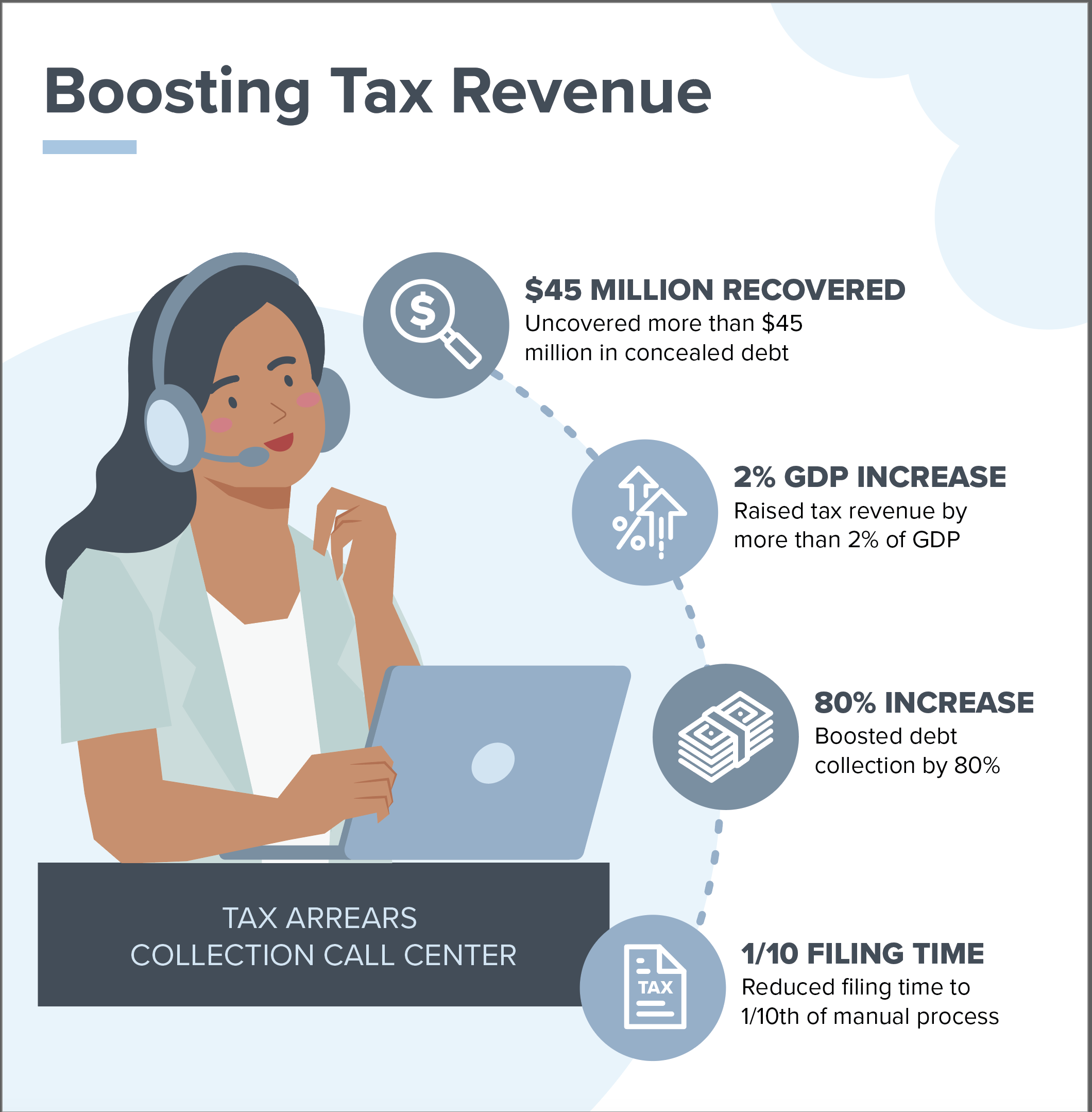

How did DRM help the government increase tax revenue by more than 2 percent of GDP? Building on USAID’s past investments, DRM focused on opportunities to mobilize tax collection by promoting voluntary tax compliance. Efforts included implementing a Tax Arrears Collection Call Center, which uncovered more than $45 million in concealed debt due to corruption and increased debt collection by 80 percent. DRM also supported the rollout of an electronic filing system that automates filing for nine tax forms related to capital gains and excise taxes, thus facilitating tax compliance and reducing the time taxpayers spent to 1/10th of the time required to file manually.

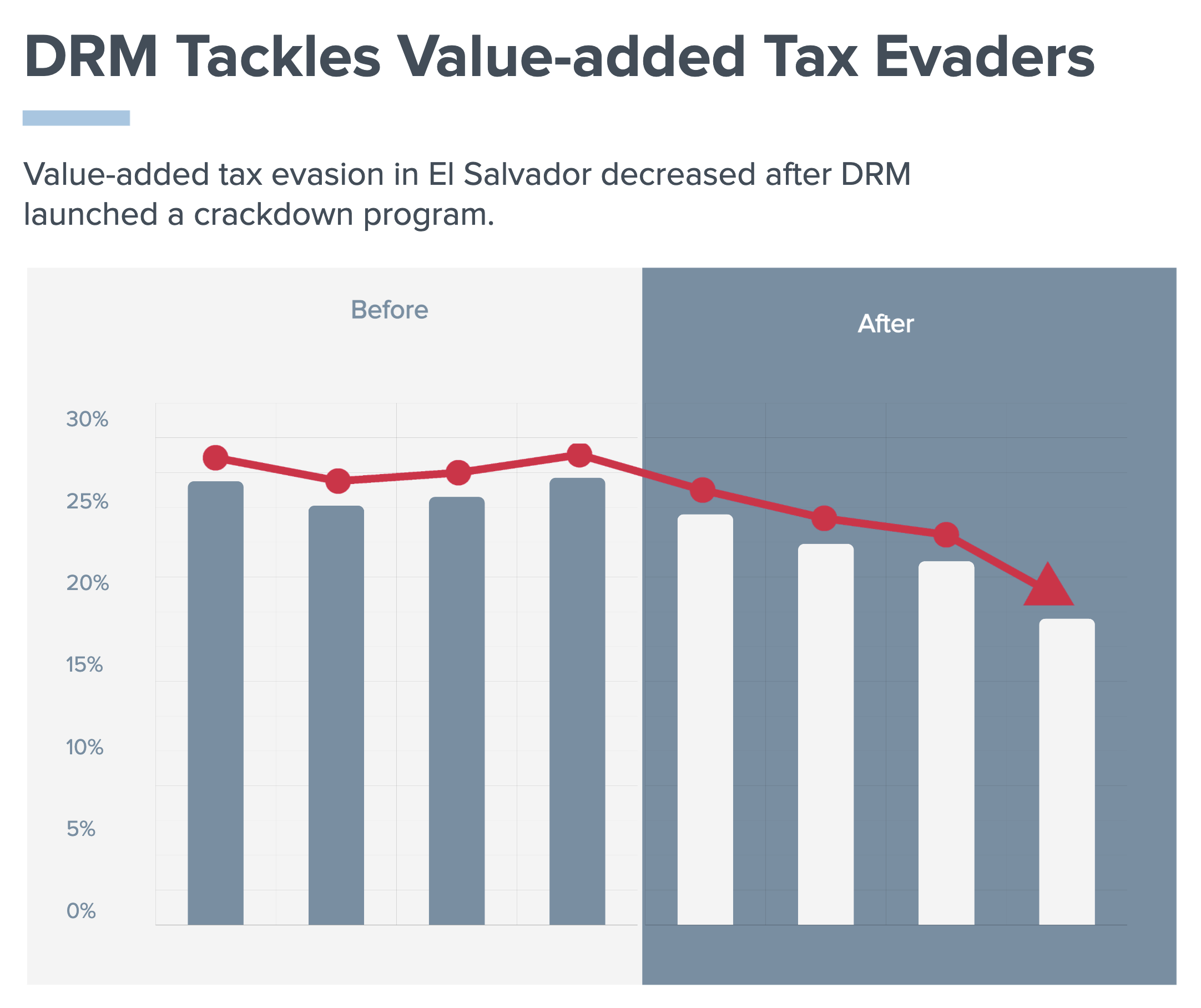

DRM also helped implement a Tax Evasion Crack-Down Program, improving staff capacity in data mining while automating case selection, case assignment, and audit execution through the Case Selection Management System II, which was developed under FPEMP. Through a massive compliance program that involves automated messaging directed at non-filers, a Tax Compliance Call Center, and a focus on specific tax fraud and evasion cases, the government was able to reduce evasion of the value-added tax by 9 percent. These efforts provide the government with the capacity, tools, and techniques to mobilize tax revenue sustainably.

Smarter Spending

When public expenditures are managed effectively and efficiently, increased revenues can translate into improved public services. DRM helped the government better manage its expenditure by reforming the Treasury Directorate and automating cash planning and management through the integration of two technology systems: the treasury submodule (SITEP II) and the integrated financial management information system (SAFI II). This integration better aligned cash inflows and outflows, lowered borrowing costs, and strengthened payment controls.

DRM supported the government to implement international public sector accounting standards (IPSAS) by developing a public accounting subsystem that registers real-time government financial operations and by upgrading to the next-generation SAFI II system, which automates and integrates the various components of the budget cycle, including budget formulation, public accounting, treasury, investment, human resources, debt management, and public procurement. DRM also built government capacity in results-oriented budgeting through an e-learning program for staff from the ministries responsible for finance, health, education, justice and public safety, and water services.

More Open Government is Better Government

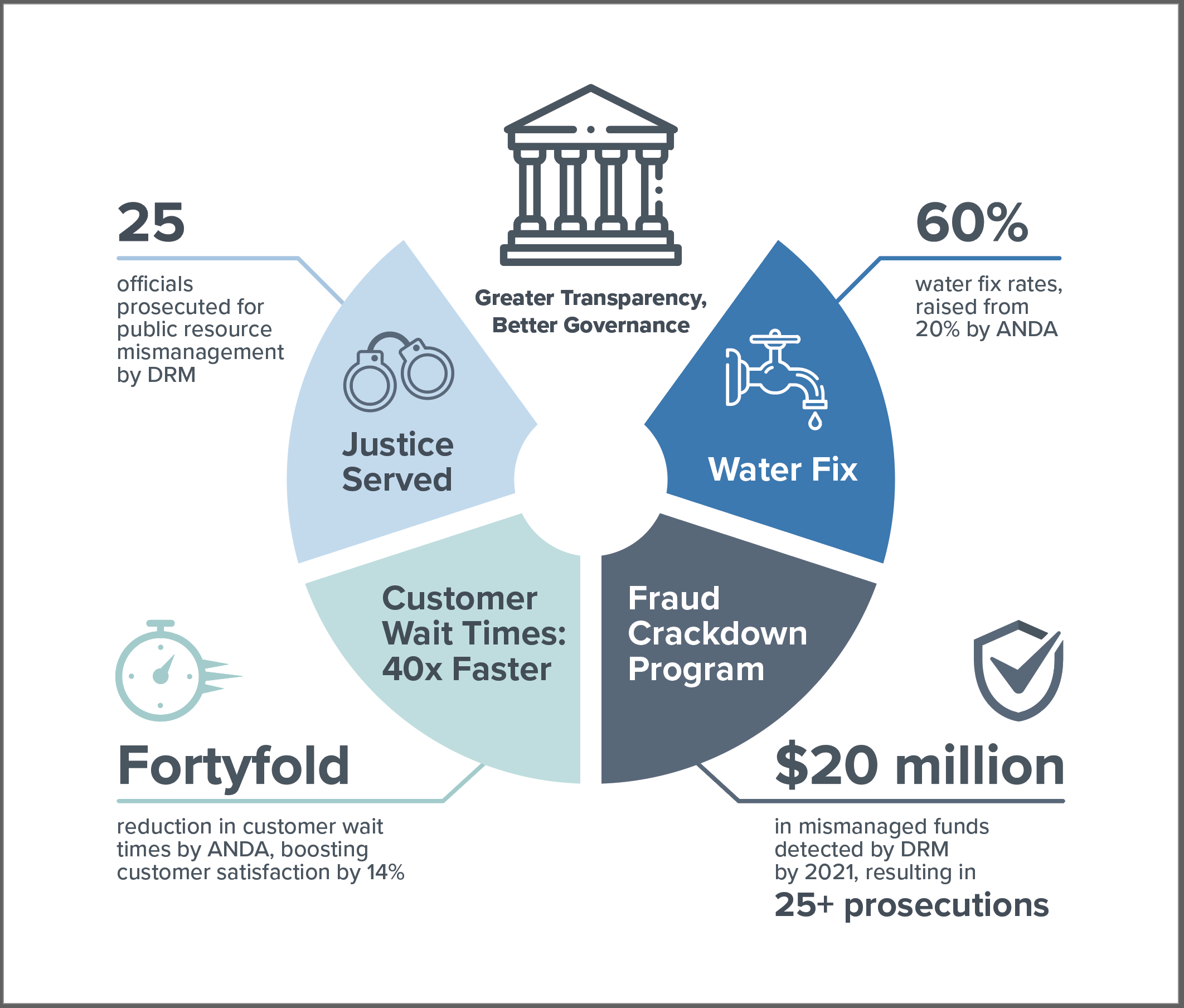

A successful government is one that is transparent and accountable to its citizens about how public resources are spent. To that end, DRM supported the Supreme Audit Institution—the Court of Accounts—in designing and implementing a Fiscal Fraud Crackdown Program, which kicked off in 2019. The program enhanced auditors’ ability to apply new risk-based methodologies for fraud detection and audit case selection, to undertake investigations following best practices, and to apply quality standards in preparation of audit reports, thus improving the effectiveness and productivity of audit cases.

By the end of 2021, newly trained auditors had detected $20 million in mismanaged public funds. In addition, DRM helped collect evidence to prosecute more than 25 officials for charges related to public resource mismanagement. The team also helped implement the International Standards of Supreme Audit Institutions, which promote quality assurance of audits as a tool for more effective and transparent government.

DRM supported the National Aqueducts and Water Utility Agency (ANDA) with assistance in strategic and financial planning, improving its budget programs and establishing a Citizen Service and Anticorruption Call Center. As a result, ANDA increased customer satisfaction scores by 14 percent, reduced customer wait times fortyfold, improved water issue resolution rates from 20 to 60 percent, and facilitated a new corruption complaint mechanism that resulted in prosecuting 13 public and private agents for fraud. These efforts are enhancing public expenditure management and improving public services for Salvadorans.

More Than Just Taxes

Between 2017 and 2021, El Salvador benefited from nearly $1.7 billion in additional tax revenue, thanks in part to DRM’s support for tax revenue mobilization through enhanced government staff capacity, improved tax administration processes and automation, and targeted efforts to reduce tax evasion and tax debt collection. An estimated $325 million was collected in additional tax revenue between 2017 and 2022 as a direct result of cases selected and funds collected through the Case Selection Management System II and tax evasion crackdown program, supported by DRM. USAID’s investment in tax-related support was estimated at $3.8 million over this period, meaning that DRM yielded at least $86 in additional tax revenue for every dollar of USAID investment.

Another key project outcome is the results-driven culture in government institutions and units supported by DRM. As DAI undertook annual performance evaluations year after year for almost a decade, government partners demonstrated a growing willingness to adopt and rigorously apply performance indicators and results monitoring in their workplans. USAID’s public financial management projects have shifted mindsets, leading to improving performance and deepening impact. USAID recently tapped DAI to continue its support of ANDA to modernize, adopt best international practices, improve the quality and opportunity of the provision of clean water to its current customers, and expand service coverage to part of the 30 percent of the population that has been waiting for decades to receive the needed service at their homes.

The project will support ANDA in the update and implementation of its business plan, rollover of its modernization program, improvement of the operational system, implementation of an energy efficiency pilot, implementation of a strategy to reach out to civil society, young people, and private sector, and improve transparency and accountability.

The Road Ahead

El Salvador still has obstacles to overcome to ensure fiscal consolidation and budgetary sustainability. Nonetheless, the country’s rise in tax revenue has allowed it to invest more in basic public services, including health, education, public safety, and public infrastructure. A closely watched World Bank index used to monitor homicide rates in El Salvador declined from 107 in 2015 to just 18 in 2021. Health expenditures increased from 8.32 to 9.72 percent of GDP from 2018 to 2021, according to the World Health Organization.

These favorable results demonstrate how a sustained, comprehensive approach to fiscal reform—combining enhanced capacity, improved processes, and modern tech tools—can bring about significant returns on donor investments. These results may not be visible immediately but can have an impact in the short, medium, and long term. With the recent re-election of President Nayib Bukele in El Salvador, it will be important for donors to continue supporting programs that promote fiscal responsibility, sustained revenue generation, and improved public expenditures and service delivery so that Salvadorans can thrive at home, enjoy improved living standards, and move forward with a sense of hope that gives them the motivation to support the national economy.